As much as I’m opposed to most Wall Street proverbs and idioms, there are a small select of them that bear wisdom. “Don’t fight the trend” is most certainly one of them.

As we discussed before, no sane speculator will buy a down-trending stock, and then go on to hope that the trend will reverse by itself to the upside. If you fight the trend in that way, you will very quickly realize that it’s a great recipe for losing money. Equally, many a short-seller has lost his shirt trying to short an up-trending stock, insisting that it was over-valued. Trends, once in motion, continue to maintain momentum in the same direction, driven by a chain of crowd psychological phenomena – that is, until a major force acts against the trend to reverse it. That happens less often than the “value investor” camp would have you believe.

The trend is your friend. You will simply never make any money unless you begin and end every trading thought with that in mind — Paul Tudor Jones

Many stocks trending in unison cause general market movement

As much as “Don’t fight the trend”, or its synonym “The trend is your friend”, goes for any individual stock, it equally applies to the wider stock market. As the stock market is really a market of stocks (i.e. a very large & diverse group of stocks), the same overarching causes in crowd psychology that move one stock tend to do the same in other stocks, stronger or weaker, as a primary force, or psychological “spill-over” of sentiment. The latter is because the same future expectations of economic forces and business outlook, if they are sound and valid broadly, will apply to many others. Market participants see trends in some stocks, and expect that the same changes in sentiment or economic/business outlook will also affect other stocks in the same way. They will thus buy other stocks in the market, which they believe to be still under-valued, or similarly strong, leading to capital inflows into these other stocks and thus laggards following the leaders, or even the formation of new leaders.

The truth again lies in the power of institutional money. As many of the thousands of institutional investors, each managing hundreds of millions to many billions of dollars, will have similar strategies and thus similar timing of entering/exiting the market, many of them will act more or less on the same conditions and signals in harmony. Due to their sheer size, each has or wants many existing or prospective large positions in stock they cannot exit/enter in a single day/week/month. Thus, many of them as a group act more or less harmonized, and will start causing trends or reversals of trends in many individual stocks, which finally causes the phenomenon of broader trends across the market.

Since stocks thus tend to move in groups (e.g. industries, or the market as a whole), buying a stock against the overall group/market trends down is inherently burdened with low likelihood of success. This is as true for buying a single erratically up-trending stock that is trying to advance out of a digestion while the vast majority of stocks are consistently selling off, as it is for shorting a single stock that is seemingly breaking down while the overall group/market is trending up. Here again, the nature of the stock market as a stochastic animal (i.e. based on odds and probabilities) comes into play – a single stock may continue trending up in a down-trending general market – it is just highly unlikely that it does so at all, or does so with its volatility staying low enough to allow proper risk management.

“Market health” is about much more than just the index trend

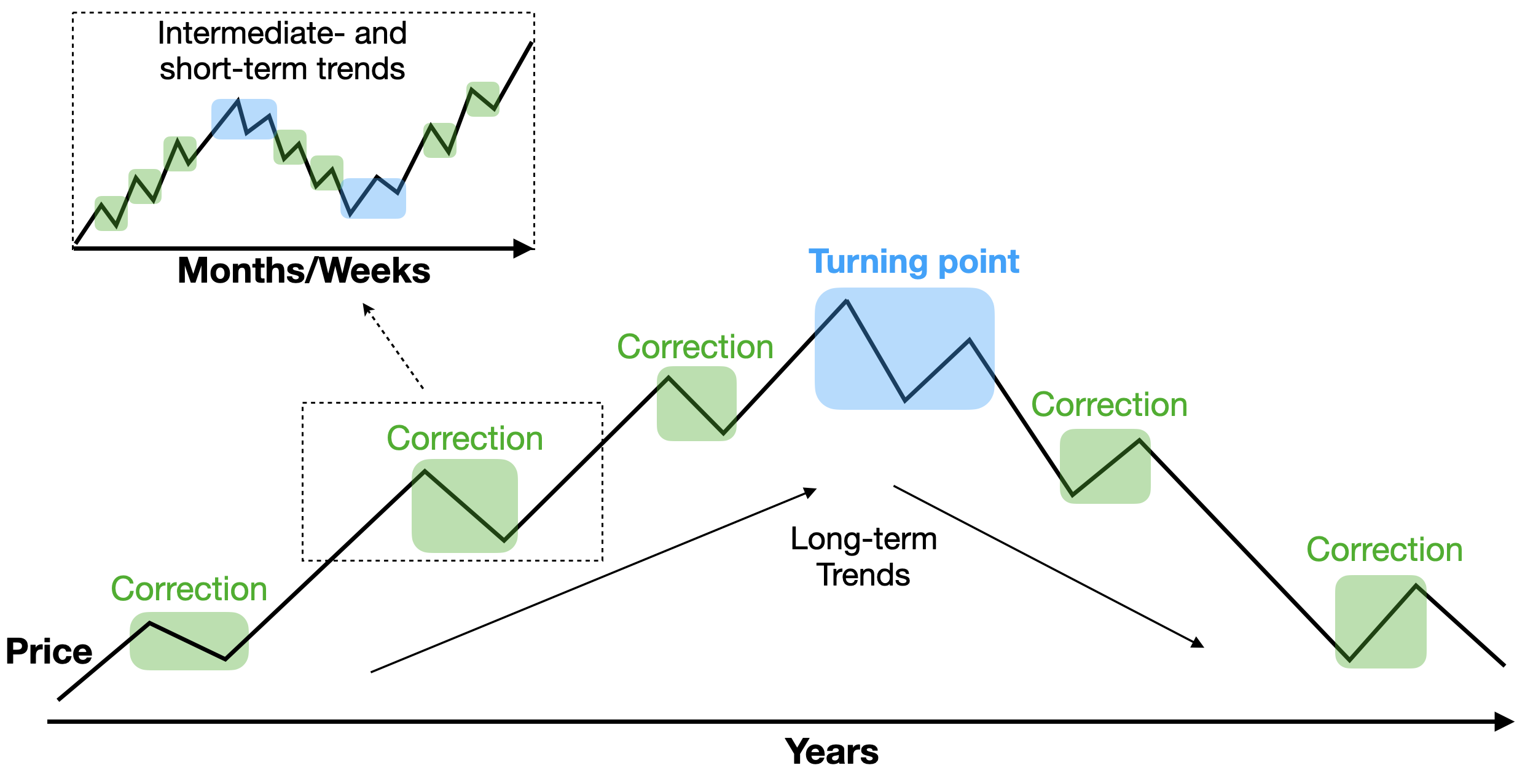

As we learned before, we are looking for the strongest stocks in the market. We aim to enter them when they move out of a constructive digestion while the general market trend is headed up or once it is about to start turning into an up-trend again. Recall the graphic below from an earlier guide:

In fact, you should never ever try to buy a new stock if you can’t observe that the market is reliably in the process of just turning up, or already in a strong and healthy uptrend.

This course later contains a separate part that is concerned with the analysis of the general market, or what I call “Market Health“. General market trends can be read, or rather, approximated, using the indices.

The general market trend is similar to a compass that shows you true north. You can act against it, but you will keep walking in the wrong direction regardless. Because of your freedom as an individual speculator, you can get out anytime out of anything – a gigantic advantage over institutional investors, who have to resort to wide diversification, safe havens, etc. That means you need to be able to read the general market, and establish its true direction.

We will learn how to use trend analysis, the 1-2-3 trend reversal concept, and moving averages to determine the trend of the general market indices.

We will further learn to analyse what and who is really behind market moves and how reliable they are, looking at various secondary indicators for “market breadth“, including index group confirmation, advance/decline metrics, new-high new-low gauge and sentiment markers, etc.

However, the real Pros understand that indices and secondary indicators can only tell us so much. The real insight comes from looking at individual stocks. We speculate in single stocks, so these will be the cornerstone of our market health analysis.

The later part of this course will get you present to you a methodology that analyzes the health of the general market in a way that enables you to tell whether it is conducive to speculation in stocks in up-trends, i.e. whether the odds of successful speculation are on your side or turned against you.

This methodology looks at a combination of factors, but can be summed up as analyzing the most important stocks that are most bought up by institutional money, to gain an insight of where we are in the market cycle.

Analyzing the leaders

Think back what we learned about the concept of leading stocks. They are “leading” the market, because a large number of institutions are shoveling money into them, buying large positions in them over long time-frames.

Institutional investors, at least the smart ones, are very diligent where they put their money when. Since their activity is reflective of 75% of trading activity on the exchanges, they are who make or break the market and trends in the stocks that make it up.

The “behavior” of leading stocks, i.e. their price-volume action, reflects what institutional money as a group is doing – how they see the market, how lenient they are, what their risk appetite is. Monitoring leading stocks and their price/volume behavior means monitoring the group of actors that are in control (make or break) of the stock market, and tells us whether the general climate in the market is conducive to the formation of strong trends and speculation in them.

Market “health” thus is not only looking at index trends or secondary indicators such as breadth. In fact, they are a lesser part of it. What really tells you what you can expect from a market, you need to analyze the leaders – the quality of the stocks that are being bought by institutional money, the quantity of them, and in reverse, what stocks are being sold by them, or avoided.

This part is one of the main skills that a speculator needs to possess to be successful. We will cover leadership quality, quantity, liquidity, technical signatures, sector enrichment, etc.

Analyzing digestions in high-quality leaders

If you think back to the previous lesson on digestions, I was listing the criteria that a low-risk entry point requires:

- it has the lowest risk of you getting stopped out on random volatility or a pullback in price,

- it has the highest chance of an uninterrupted continuation of the trend after you buy,

3. indicates price ranges at which we can tell whether supply and demand in the wider market are in a healthy balance that is conducive to speculation in uptrending stocks.

You always need to be in sync with the market

The general market does not always trend up – in fact, it does so only about a third of the time. The rest it spends aimlessly meandering, or “chopping” sideways, where many stocks mirror that motion, or trends down. While down-trending markets can be profitable via shorting, this remains a topic for a wholly separate educational course since it has its own quite considerable complexities that can quickly become overwhelming.

We want to capitalize only on the times where markets are in an up-trend, and magnify our profits by identifying and buying the strongest stocks that magnify the general market trend the most (see above schematic). Hence the requirement for a stock speculator “long” or “short” the market to be in sync with the trend and only operate in a healthy market.

You will always need to look at the trend and the health of the market and be in sync with it. Ask yourself, why should you get involved with something that might turn into a trend that might or might not continue, when you can just jump on one that you know is already happening? Why try to participate in a stock rally in a bear market when there are no institutional buyers buying up and causing strong trends in many great stocks? Why participate in side-ways market where digestions consistently fall apart? There is no real money to be made, so we must wait.

Only joining a healthy market in an up-trend might sound trivial to you, but I assure you it’s not – the devil is in the detail. Finding such a market, and the psychology involved in abstaining from getting chopped up in a hostile market or in sub-optimal stock opportunities has driven many a speculator to frustration and defeated many into turning their backs on speculation as an endeavor. It is one of the large reasons that advanced swing-traders and trend speculators lose a lot of money and/or their previous profits.

Knowing what really characterizes the transition between good and bad markets, and being able to tell the difference between one that only looks healthy and one that truly is healthy, requires taking a deeper look under the hood. As every trend, and even side-ways market consists of a smaller set of sub-trends in the short- and intermediate-term scale that can be , there are a lot of false signals that are mistaken by the wider investment community for new genuine trends.

We always have to remember that we don’t have to be in at the exact bottom of a bear market or correction, and we don’t have to sell at the exact top. As we discussed earlier, it’s about that middle meaty portion of a trend which is already underway – not about getting into every single rally in the indices and into every hype that the financial media are conjuring up. Trying to be in and out at the exact bottoms and tops will likely cost you more than the money you made in the meaty part of the trend, be it in a stock or in the general market.

Say no to losing a lot of money and sanity trying to get 100% of a trend and thus having to be involved in every little jiggle of the market – a bit of patience can get you 90-98% of the move and a multiple of the profits because you weren’t constantly losing money getting chopped up hostile markets.

Once a certain skill has been acquired, i.e. what will be covered in this course, a large part of staying out of bad markets and piling into good ones has to do with correct trading psychology. Read the last introductory guide into this topic next, before we wrap up and get down to business to learn the details of speculation in stocks.